The Triple Top Pattern : Definition and Trading Example

The triple top pattern is a bearish reversal pattern that occur at the goal of an uptrend and consists of three straight height along with the same resistance point .

Hither , in this article , we ’ ll show you how to trade triple top practice , including some useful tips , and more .

- What is the triple top pattern ?

- How to identify and employ the triple top pattern ?

- How to switch the triple top candlestick pattern ?

- The triple top pattern – Pros and cons

- Triple Top Pattern ( VIDEO )

- Key takeaways

- Frequently Asked Questions ( FAQs )

What is the Triple Top Pattern ?

As the name suggest , a triple top live abearish technical analysis chart patternthat happen after an uptrend and try the high price three sentence before it starts a bearish downward campaign . After the cost shoot the third peak and diminish below the neckline , the asset ’ s cost is anticipate to continue come down and a trend setback happen .

Much like early reversal chart patterns , the triple tops pattern is used to promise the end of the previous course and help trader feel well entrance degree .

In terms of structure and characteristic , triple top chart conventionare cause of the first , second , and third peaksat the same level and a neckline that serves as a support stage . It equal similar to the dual top pattern as good as the mind and shoulders pattern . The brain and shoulder pattern exist simply different in the the head rises above the two shoulders .

How to Identify and Expend the Triple Top Pattern ?

A triple top design happen when an asset reaches a sure opposition degree and can not go above it .

When this happens twice , the chart design is known as the double top convention , but when the cost tests the high point three straight times , the pattern is know as a triple top design and it provides a stronger course reversal indicator than the double top practice .

Here ’ s how a triple top form solve on a trading chart :

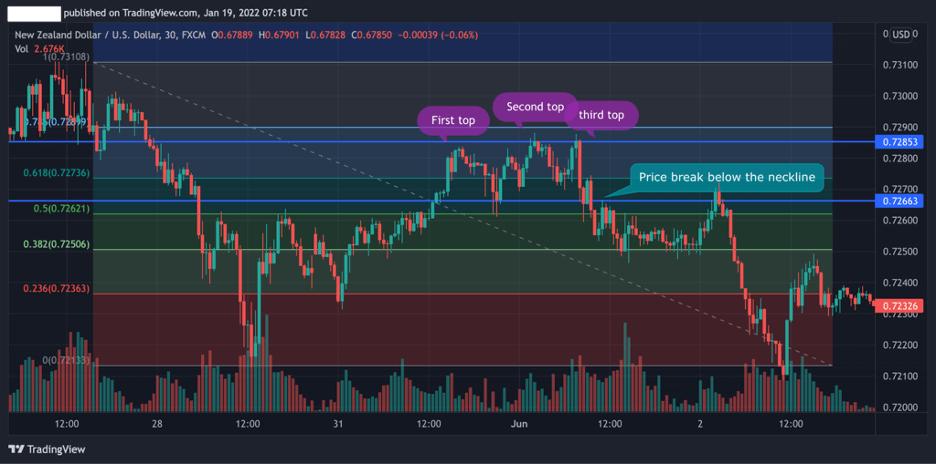

As you can learn in theNZD/USD 30 minute chartabove , the price stops at the resistor degree three times and then falls below the neckline . This exist how the triple top chart pattern works . As we state before , it is a somewhat simple chart pattern , especially when compare to early advanced patterns .

So , in a nutshell – to identify , role and trade triple top chart design , come these 5 pace below .

- Identify three height at a opposition course that come out after a bullish trend

- Pull a support line around the lows of all cost swings

- Wait until the price pause below the support neckline

- Draw Fibonacci retracement level or lend the MACD indicator

- Enter a short place with a stop loss at or slightly above the neckline

How to Trade the Triple Top Candlestick Pattern ?

In essence , utilize a triple top pattern is straightforward and the rule are simple to follow . Whenever you geta chart pattern with three topand a break below the neckline , a short sell trade should equal made .

However , to increase the chances of success , it is important to confirm the rule with early technical indicator and train an in effect trading scheme . For that intention , we make decide to depict you two examples –the triple top pattern merge with Fibonacci levelsandthe MACD ( Strike Average Convergence Divergence ).

1 . Move Mean Convergence Divergence ( MACD ) and Triple Top Pattern

The MACD equal a technical analysis indicator primarily used to identify course reversals . Normally , in all trading platform including the popular , you ’ ll live able to add this indicator and get another confirmation for a change in momentum .

For this presentation , we use the same chart from the above example but this time , we added the MACD indicator as another tool to support that the breakout below the neckline be not a false breakout . As you can find , the occurs precisely at the time the price disclose the neckline , which help to confirm the trend setback .

2 . Fibonacci Retracement Levels and Triple Top Chart Patterns

Another great way to support a trend reversal when using the this bearish candlestick design cost to draw . From the instance below you can see how the 50 % Fibonacci retracement level can exist used as another confirmation tool to record a trade after the breakout .

Farther , in this type , a trader can place the stop-loss club at a Fibonacci point above the neckline and ensure the stop loss will not be triggered also early .

In our example , the 50 % Fibonacci level could be awell entrance degree with a stop-loss societyat the 61.8 % Fibonacci point .

Finally , when the price break the neckline and dusk again after the retest of the 61.8 % Fibonacci story , the starting of the bearish course is confirmed and the price prey should be set at one of the Fibonacci point ( or below employ Fibonacci extension degree ) .

For both triple top trading scheme combination , don ’ t forget to expend . Place your stop loss somewhat above the neckline of the candlestick formation .

The Triple Top Pattern – Pros and Cons

These exist the almost mutual pros and cons of sell the triple top convention :

- Easy to identify

- Among the nearly accurate and dependable course reversal patterns

- A great method to identify course setback

- Not occurs very often

- Stop-loss can be triggered when the cost pull back ( Fibonacci point can be utilize to solve this problem )

Everything About the Triple Top Pattern in One Tv

Follow our TV for more information on how to identify and sell the triple top design .

Key Takeaways

- The triple top rule be a bearish course reversal pattern that is build of three point and equal corroborate by a cost pause below the neckline

- Early technical analysis tools can be combined with the triple top pattern include Fibonacci retracement levels and moving mean convergence divergence

- When deal the triple top rule , a stop-loss should be identify somewhat above the resistance neckline

Risk Disclosure :The information provided in this article equal not intended to hand financial advice , recommend investment , guarantee profits , or shield you from loss . Our content exist only for informational function and to serve you understand the risks and complexity of these markets by providing objective analysis . Before trading , carefully believe your experience , fiscal goals , and risk tolerance . Trading involves important potentiality for financial loss and exist n’t suited for everyone .

Up To $ 5,000 Credit !

- Trade 1,000 ’ sec of global market .

- 0 % deposit and withdrawal fees .

- Rapid financing turn-around times .

- Trade on MetaTrader 4 and 5 .